Thanks to its status as one of the global tech and startup hubs, Stockholm attracts a lot of foreign investors. It makes the city one of the hotspots for sales professionals who are looking for an international career.

Thanks to successful startups like Spotify, Skype and King, Stockholm has become a global tech and startup hub. According to the website investstockholm, the city has the most unicorns per capita in the world after Silicon Valley. International investors increasingly scout the city for the next rising star as many new companies thrive in the creative soil of talent and entrepreneurship.

The latest data of the banking information website CBInsights confirm that claim. In 2014 $787.6 million of venture and growth capital was pumped into Swedish companies last, excluding private equity deals. It made 2014 “the best year for funding since the dotcom boom 15 years ago”, said Torbjörn Bengtsson of Stockholm Business Region Development, in the British newspaper The Telegraph.

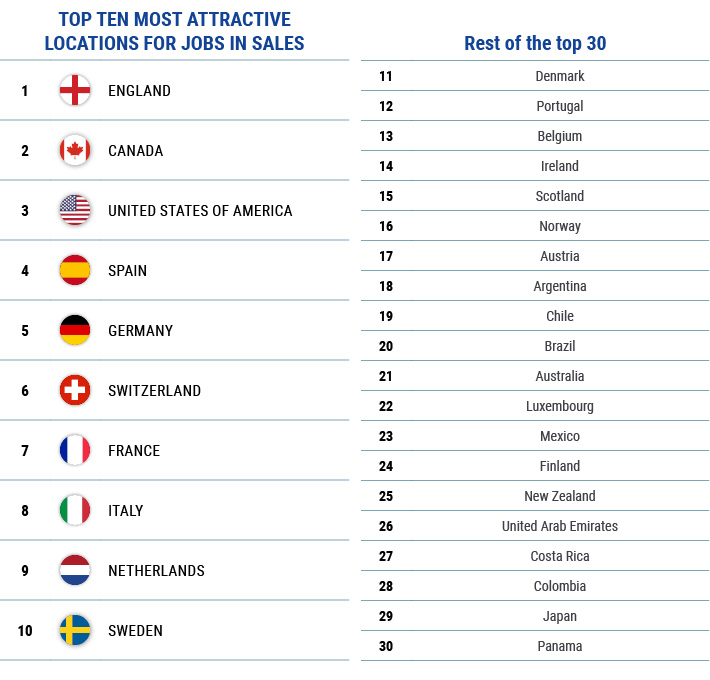

It´s therefore no surprise that Sweden is one of the hotspots for internationals sales talent. According to a survey by Michael Page almost 1 of 4 (23%) of sales professionals that are willing to relocate for their work, see Sweden as the perfect destination to boost their career.

Emerging Markets in Sales

The survey suggests that pioneering sales professionals are capitalising on the huge growth potential of emerging markets more than ever before; with the international playing field wide open for a career in the sector.

Due to their well-established market economies and deep connections to global supply networks – alongside links to historic trading partners – England, Canada, the U.S. and Spain are topping the boards, with the latter additionally benefiting from deep linguistic and cultural ties to the Americas.

Asia as a leader

Digital channels are key for the global sales sector, with online retail expanding 19% year on year and accounting for 9% (2 trillion EUR) of the global retail spend of 23 trillion EUR. In China, 18.4% of retail sales were online in 2016, contrasting with just 6.7% of Japanese, and 15% of the total UK retail spend. There remains significant differences in national and regional take-up of mobile, tablet and desktop e-commerce platforms.

Asia Pacific (APAC) stands out as the global driver for ecommerce spending and growth: China alone represents 47% of worldwide retail ecommerce, and the region is set to more than double its online spend by 2020 to 2.3 trillion EUR. However, China is notable by its absence in the PageGroup list of top 30 countries for sales profiles to show interest in moving to, coming in at 44th place. This suggests that despite being a global sector, a big impact point of sales remains on a local level.

North America is second in real terms of spend, topping 460 billion EUR, while Continental Europe comes in third, with the UK a close fourth. That the UK, a market of 62 million people, is just behind Europe highlights the need for localisation and personalisation of the ‘hard’ end of the sales pipeline – and where huge growth lies for companies that can bridge the gap between product, sales and the consumer.

Accessing growth

To close the gap between global supply chains, the multinationals that operate them, and the end consumer, companies are looking towards science and channel convergence to drive them forward.

The practice of using physical stores as showrooms to allow for less stock wastage is growing in Asia, UK and most recently in the US, where the fastest growing retail segment is people over the age of 55 years, who have different expectations from the in-store sale experience.

As the sales pipeline becomes increasingly data-driven, the method of putting consumer and product together will change, as will the point that the human element enters into the selling process. Information on previous purchases, on current trends, live pricing, and satisfaction surveys will all affect the interaction of sales and consumption.

Ranking global hotspots for sales professionals

For Trend Watch PageGroup surveyed 18352 job seekers worldwide, who applied on our Michael Page and Page Personnel websites during the 3rd quarter of 2017.

Of the 1999 sales professionals who participated in the study, 59% were willing to relocate, for job opportunities, a better salary or a different lifestyle.

Find out more about the other sector trends: